Nishant Capital

Connecting students to fast and affordable credit

Model

Services

Industry

Finance

Stage

MVP

Location

India

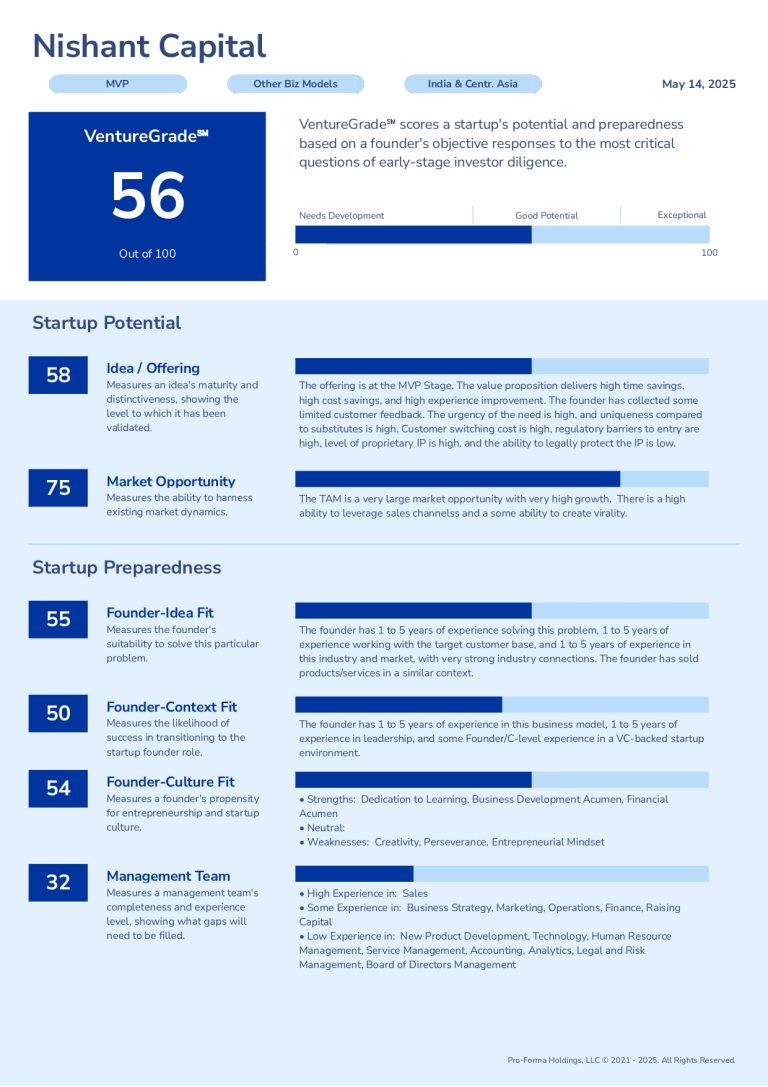

VentureGrade

56

out of 100

Connecting students to fast and affordable credit.

Elevator Pitch

As per TransUnion’s Cibil Data the total number of loan inquiries made by youngsters from age group of 18-30 increased from 5% to 43% in the last quarter. According to our surveys 8 out of 10 students face financial crunches and still don’t turn to banks due to long processes and stringent eligibility criteria.

Nishant Capital provides both secured and unsecured loans to students who otherwise find it difficult to arrange funds for their education. We also offer personalized prepaid credit cards to students by partnering with on-campus merchants to guarantee rewards for every spend.

Founder (s)

Nishant Sam

- 5 years – Investments, 1 year- Teaching

- Exited a hospitality startup (Ex Founder)

Revenue Model

We offer loans with an average ticket size starting from ₹50,000, with interest rates ranging from 12% to 36%.

Revolving Credit: Fixed interest rate of 9% AMC for Credit Cards: Fixed at ₹500 per year, waivable with expenditure of ₹60,000 and above MDR: Fixed at 1% of the transaction value

Startup Journey

Nishant Capital has a valid MVP and has been market tested. Market testing included conducting rounds of investment with a total of 58K in loans.

Declared as second best startup by Institution’s Innovation Council (IIC) at E-Verse.

Secured an office space at Maharishi Kanad Bhawan under the Government of Delhi scheme and got incubated by Udmodhya Foundation. Secured tech support from Microsoft for Startups.

Got shortlisted by venture capitalists including Famwork Ventures, USA (Sridhar), MERI Ventures, Warmup Ventures, Favcy Ventures, Fibonacci, 100x VC, Campus Fund, AJVC, Ministry of Bahrain, Zerodha and Gradcapital.

Only student startup at the ICAI Startup sphere with an audience of 10K+ CA’s. Got into top 50 startups at National Awards for Entrepreneurship amongst 15K+ applications. Only Indian startup to be incubated at Oxford University. Won a 1.25 Lakh cheque from EO.

Go-To-Market Plan

We focus on institutional partnership since the educational sector is already an organized space for easy expansion.

Potential Exit

We have no plans of getting acquired anywhere in future. Potential exits and investments are set for NCDs (Interest sharing basis) and straight up equity investments through fellow banking institutions in India – as per regulatory requirements.

VentureGrade℠